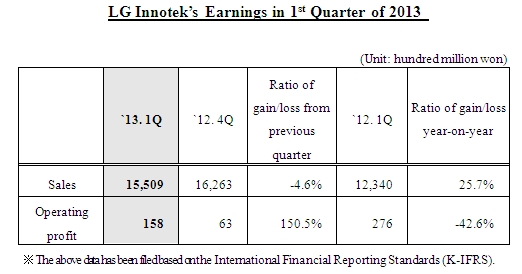

LG Innotek (CEO Ung-Beom Lee) said on April 24 it posted 15.8 billion won in operating profit on 1.5509 trillion won in sales based on the International Financial Reporting Standards (IFRS) in the first quarter. Thus, the Company continued a surplus in operating profit for five consecutive quarters since the first quarter of last year.

Sales fell 4.6 percent from the previous quarter, but operating profit jumped 150.5 percent. Sales increased 25.7 percent year-on-year, but operating profit fell 42.6 percent.

Commenting on its first quarter earnings, LG Innotek said, “Sales of mobile parts and components groups increased, and yields of new models improved, but the display business, including LED BLU (Back Light Unit), declined from the previous quarter due to seasonal factors,” adding, “However, we were able to remain in surplus due to enterprise-wise cost-cutting efforts, among other activities.”

As for performance outlook for the second quarter, the Company said, “We will push to implement performance-focused management, centered on improvement of profitability, by gradually reducing the size of deficit in business sectors of slumping performance, as well as rebound of sales in the display parts groups.

Additionally, LG Innotek plans to focus on boosting its capacity to spearhead the market, and continue to implement activities to achieve quality innovation and increase cost competitiveness in the entire business areas.

Performance by Business Sector

Optical solution business saw shipments to main customers decline, but posted a better-than-expected sales performance of 641.1 billion won due to expansion of customer portfolio, including new trading partners overseas. This represents a 6 percent drop from the previous quarter, but a 67 percent jump year-on-year.

LED (Light Emitting Diode) business posted 256.8 billion won in sales, down 7 percent from the previous quarter, due to a fall in BLU (Back Light Unit) LED demand stemming from off-demand season. The figure represents 35 percent gain year-on-year.

Printed circuit board and materials business (Circuit board) posted 401.1 billion won in sales, the same level as in the previous quarter, due to early normalization of the PKG business and rising demand for touch windows, despite a fall in PCB (Printed Circuit Board) demand from main client firms. The number represents a 29 percent gain year-on-year.

Automotive parts business posted 264.9 billion won in sales, down 5 percent from the previous quarter, as the automotive parts sector maintained growth pace due to the expansion of business scope, despite a fall in power module sales resulting from a slump of industries to which it supplies.

###